Starting an online business means more than just having a website. You need a way to accept payments smoothly and securely.

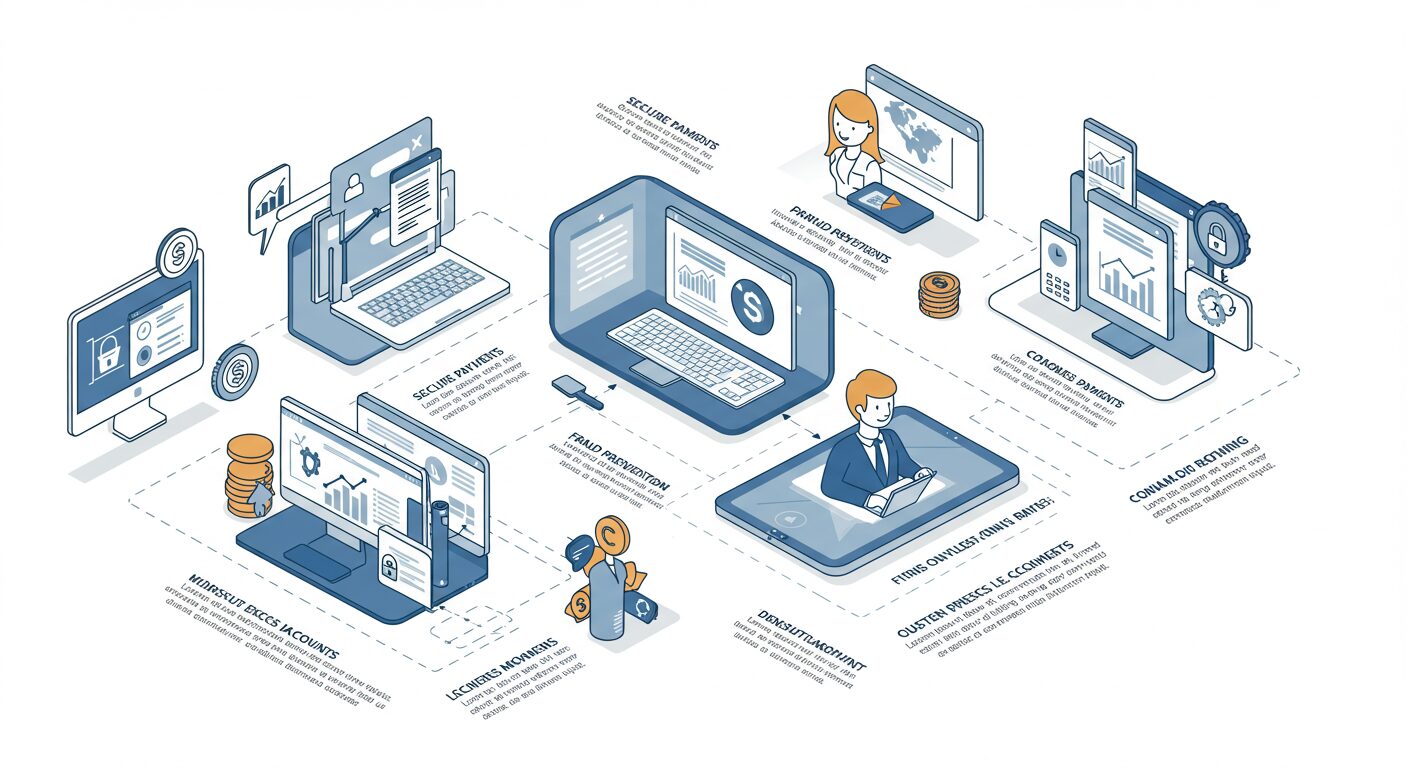

Picking the best ecommerce merchant accounts can make a big difference in your business. It impacts how customers pay, how safe their info is, and how much money you make.

In this guide, you’ll discover the best ecommerce merchant accounts for your business, what features to look for, how to choose the best fit for your needs, and what trends are shaping commerce today.

What is an Ecommerce Merchant Account?

Think of an Ecommerce merchant account as a bridge between your online store and your bank. It holds the money from customers’ credit cards before moving it to your bank account.

Unlike regular merchant accounts, ecommerce merchant accounts are built for online sales. They process payments from digital wallets, credit cards, and other electronic methods.

Having a good ecommerce merchant account builds trust. Customers want assurance their info is safe. It also helps you stay compliant with payment rules, avoiding fines or penalties.

Plus, a reliable ecommerce merchant account can boost sales by supporting multiple payment options and faster checkout. If your ecommerce merchant account is not high-risk and dependable, customers will feel more confident buying from you.

Factors to Consider when Choosing an Ecommerce Merchant Account

Consider some of these factors before you choose an ecommerce merchant account for your business:

- Transaction fees and setup costs: Know what you’ll pay upfront and per sale.

- Supported payment methods: Does it accept credit cards, PayPal, Apple Pay, or other e-wallets?

- Ease of integration: Is it simple to connect with your online store platform?

- Customer support: Can you get help quickly when issues arise?

- Processing limits: Are there caps on how much you can process monthly?

Best Ecommerce Merchant Accounts for Business

Here are some of the best ecommerce merchant accounts for business:

1. PayPal Payments Pro

With a global presence, PayPal is familiar and trusted worldwide. It offers a complete checkout solution called Payments Pro that lets you host payments directly on your site.

Customers like its buyer protections. Setup is straightforward but PayPal transaction fees can add up if you process many sales.

2. Stripe

Known for developer-friendly tools, Stripe lets you customize your checkout process. Stripe’s API supports unique payment flows and integrates easily with major platforms.

Stripe is highly secure and handles large transaction volumes. It’s perfect for growing businesses wanting more control.

3. Square

Square appeals to small and medium shops. It supports in-store and online sales with simple setup and clear pricing.

Square has omnichannel capabilities which make it easy to manage sales across your website, physical store, and mobile devices in one platform.

4. Authorize.Net

Authorize.Net is a trusted player with a wide range of payment options. It works well with major ecommerce platforms like Shopify and WooCommerce.

Authorize.Net supports recurring payments and offers strong fraud detection tools, making it good for subscription services.

5. Niche Providers

Certain providers cater to specific industries. For instance, some focus on international sales, while others excel with subscription billing. These are worth exploring if your business has unique needs.

How to Select the Best Ecommerce Merchant Account

Consider these tips when selecting the best ecommerce merchant account for your business:

1. Transaction Fees and Costs

Compare upfront fees, monthly charges, and per-transaction costs. Small sales volume might not justify steep monthly fees. Larger volumes might benefit from lower per-sale rates.

2. Payment Methods Supported

Customers expect options like credit/debit cards, digital wallets, and alternative payment methods. Supporting multiple channels can boost sales.

3. Integration and Compatibility

Ensure your chosen provider easily connects with your ecommerce platform. Good API support and straightforward setup reduce headaches later.

4. Security and Compliance

A PCI DSS-compliant merchant account protects customer data. Fraud prevention features and chargeback management save money and headaches.

5. Customer Support and User Experience

Round-the-clock support ensures quick fixes when problems happen. An easy-to-navigate dashboard makes management simple for non-tech users.

Tips for Selecting the Best Ecommerce Merchant Account

- Do a clear cost-benefit review based on your expected sales.

- Read reviews and case studies to see how others experience the provider.

- Test platforms with free demo versions or trial periods.

- Talk with sales reps or industry experts for advice.

- Think about your future needs as your business grows.

The way we pay is changing fast. More companies are adopting omnichannel payments, letting customers buy online, in-store, or through mobile apps effortlessly.

International sales are growing, making global payment support a necessity. Security keeps improving with newer fraud detection tools to keep both sellers and buyers protected. Providers are continually updating their features to meet these demands, giving you more options and fewer worries.

Conclusion

Choosing the right ecommerce merchant account is crucial for your online success.

Focus on factors like fees, security, and compatibility with your platform. Match your choice to your business size, sales goals, and customer base. Keep an eye on new trends so your payment system stays current and secure.

Staying updated ensures your online store remains competitive. Regularly review your merchant account options and switch providers if needed. The right payment partner can help your business grow and thrive.

Start by assessing what your business needs now. Contact top providers for demos or advice. Don’t hesitate to ask questions or share your experiences. A smart choice today can set the stage for more sales tomorrow.

I am Adeyemi Adetilewa, the Editor of IdeasPlusBusiness.com. I help brands share unique and impactful stories through the use of online marketing. My work has been featured in the Huffington Post, Thrive Global, Addicted2Success, Hackernoon, The Good Men Project, and other publications.